The Incredible Benefits of Cost Seg Study for Your Business

When it comes to maximizing tax savings and optimizing your financial strategies, one powerful tool that businesses often overlook is the cost seg study. This specialized analysis can provide substantial benefits by accelerating depreciation deductions and increasing cash flow, ultimately leading to significant tax savings.

What is a Cost Seg Study?

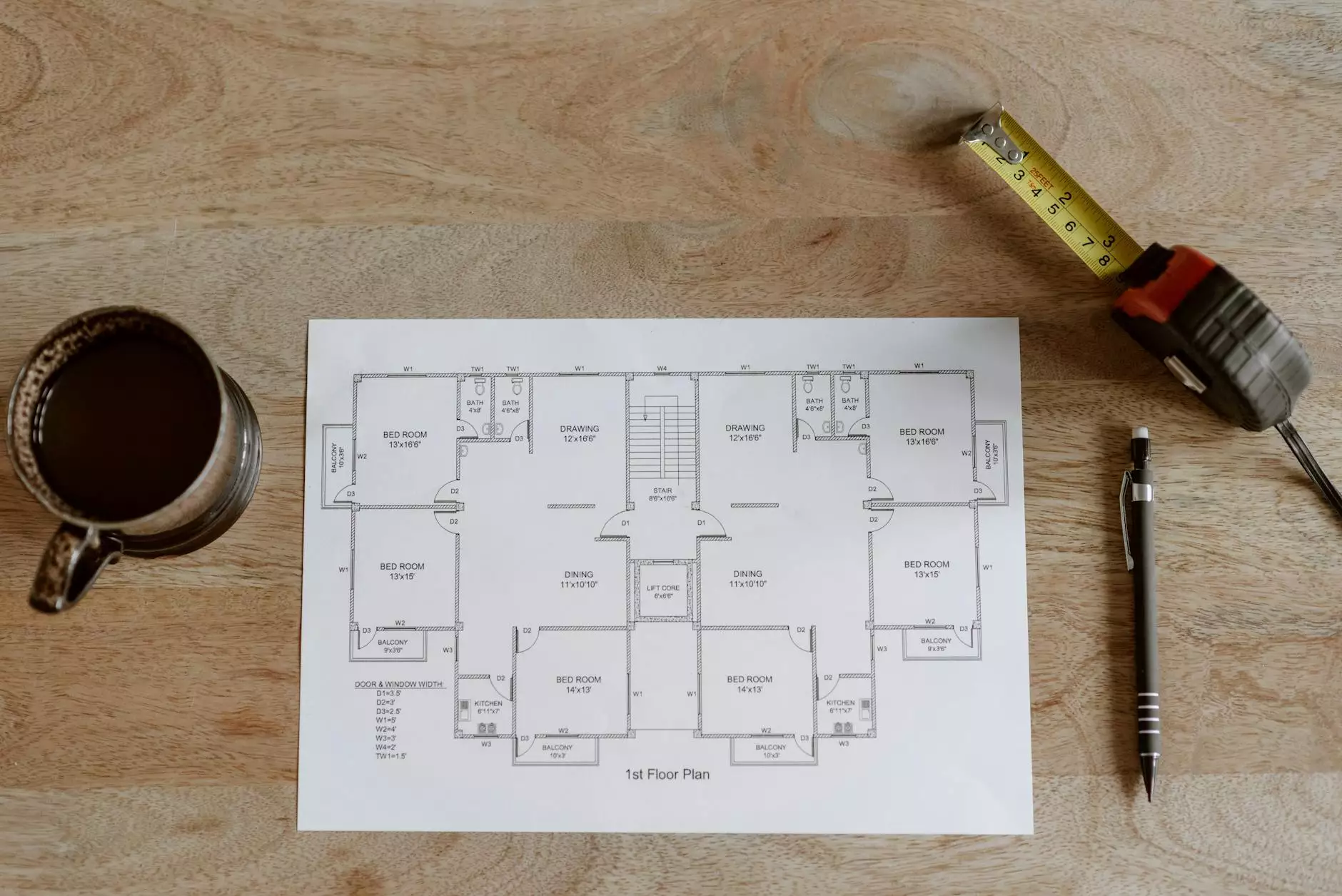

A cost segregation study is a detailed analysis of the components of a building or property to identify specific assets that can be classified for shorter depreciable lives. This process allows for accelerated depreciation, which in turn can result in immediate tax savings for property owners.

Benefits of Cost Segregation

Implementing a cost seg study can offer a wide range of benefits for businesses in the Financial Services, Accountants, and Tax Services sectors:

- Maximized Tax Deductions: By identifying assets that qualify for accelerated depreciation, businesses can significantly reduce their taxable income and maximize their tax deductions.

- Increased Cash Flow: Accelerated depreciation results in lower tax liabilities, leading to increased cash flow that can be reinvested back into the business.

- Improved ROI: Cost segregation studies can enhance the return on investment for property owners by unlocking hidden tax savings and increasing overall profitability.

- Compliance and Audit Support: Properly conducted cost seg studies provide documentation that supports tax positions and can help businesses navigate audits with confidence.

How Tax Accountant IDM Can Help

At Tax Accountant IDM, we specialize in assisting businesses in the Financial Services, Accountants, and Tax Services sectors with comprehensive cost segregation studies. Our team of experts is dedicated to helping you unlock tax savings and optimize your financial strategies.

By partnering with Tax Accountant IDM, you can benefit from:

- Customized Solutions: We tailor our cost seg studies to meet the unique needs of your business, ensuring maximum tax benefits.

- Expert Guidance: Our experienced professionals provide personalized advice and guidance throughout the cost segregation process.

- Maximized Savings: We are committed to helping you identify every available tax-saving opportunity to maximize your overall savings.

- Long-Term Support: Our relationship with clients goes beyond the initial study, as we continue to provide ongoing support and assistance for your financial needs.

Unlock Your Tax Savings Today

Don't miss out on the potential tax savings that a cost seg study can offer your business. Contact Tax Accountant IDM today to schedule a consultation and discover how we can help you optimize your tax strategies and improve your financial outcomes.

Take the first step towards greater tax efficiency and financial success with our cost segregation services. Let us help you unlock the full potential of your tax deductions and savings.

Visit Tax Accountant IDM for more information on our financial services, accountants, and tax services.